Track live investment activity

At Eastwave Capital, we’re redefining financial success through innovative trading solutions and unmatched expertise. Our platform merges cutting-edge technology, robust security, and a client-first approach to deliver exceptional returns in cryptocurrencies, forex, commodities, and indices. With transparent investment plans, guaranteed profits, and a global community of trusted investors, we empower you to achieve financial freedom. Join thousands of satisfied clients and start growing your wealth with a market leader today.

At CryptoVerse, we’re revolutionizing how the world interacts with digital currencies. Our platform combines advanced technology, unparalleled security, and a user-centric design to make crypto accessible to everyone. From seamless trading to in-depth market insights, we provide the tools you need to succeed in the decentralized economy. Join a global community of over 1 million users and start building your wealth today. At Eastwave Capital, we're transforming global finance through expert trading solutions and institutional-grade security. As a trusted leader in cryptocurrency, forex, and commodities trading, we combine cutting-edge technology with proven investment strategies to deliver consistent, high-yield returns. Our platform offers: Guaranteed ROI Plans (Up to 288.84% annual growth) Multi-Asset Trading (Crypto, Forex, Indices, Commodities) 100% Secure & Refundable Investments Global Community of 50,000+ investors across 8+ countries

At Eastwave Capital, we're redefining wealth creation through institutional-grade trading solutions. As your trusted financial partner, we deliver: ✅ Proven Performance - 121% to 288% annual growth since 2021 ✅ Diversified Portfolios - Crypto, Forex, Commodities & Indices ✅ Guaranteed Returns - Up to 1.75% daily ROI on expert plans ✅ Military-Grade Security - 100% refundable, risk-protected investments ✅ Global Network - Serving investors across 8+ countries Our team of 50+ financial experts combines cutting-edge technology with decade-long market experience to grow your capital consistently. Whether you're starting with 50 o r 50or50,000, we provide the tools and transparency for sustainable wealth growth. Join 10,000+ investors already experiencing financial freedom with Eastwave Capital.

UK-registered company with encrypted transactions, two-factor authentication, and segregated client accounts. Your capital is protected at every step.

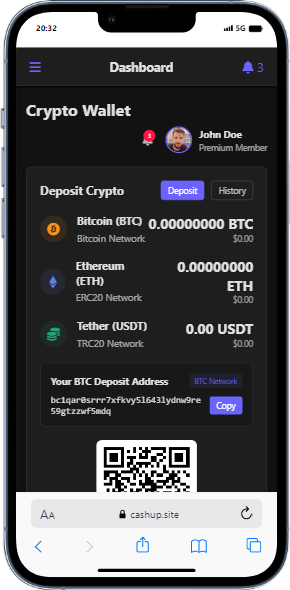

Receive your earnings within minutes via multiple options: Bitcoin, Ethereum, USDT, or direct bank transfers. No hidden fees or withdrawal limits.

Earn 1.10%-2% daily ROI through our scientifically-backed trading strategies. All plans include 100% principal protection with refundable contracts.

Start with just 20$ (BASIC PLAN) or scale up to 20,000$(SAVING PLAN), Enjoy higher returns at every investment level with transparent profit structures

Annual Growth

Global Presence

Capital Clearance

Financial Experts

Refundable Plans

The future of high-yield investing is here. Join Eastwave Capital to access guaranteed ROI plans, institutional-grade trading, and a global community of successful investors. Your financial freedom, our proven expertise.

Join Now