6 Best Insights on Silver Price Fintechzoom

Do the turbulence in the markets and the state of the economy concern you as well? And you’re trying to find a secure place to put your money? If so, Silver Price FintechZoom is the ideal location for you!

Stocks, bonds, and real estate investments are all quite risky during these unpredictably turbulent times. Everyone is searching for other things that they may invest in and turn a return on quickly in our current circumstances. Purchasing silver is a secure choice for this reason, just like purchasing gold.

Due to its historical worth and numerous industrial uses, investors are beginning to view silver as a secure investment option. Silver Price FintechZoom is a platform that has transformed how investors may view and acquire silver market data in this hour of need. FintechZoom’s Silver Price offers up-to-date pricing information, market insights, and performance evaluations of the Silver market, enabling silver investors to make knowledgeable investment choices.

The price of silver varies greatly, so you should be aware of this before making any investments. Therefore, you should deliberately invest in silver and profit from it.

We’ll go into great detail on Silver Price FintechZoom in this post, along with several tactics you may use to increase your investing returns.

UNDERSTANDING THE FUNDAMENTALS OF SILVER PRICE FINTECHZOOM

When making investment plans, it is customary to conduct thorough due diligence on the asset. Silver Price Fintechzoom Cost You may learn more about the Silver market’s tendencies with the aid of FintechZoom. This thorough analysis will assist you in making well-informed selections.

As an asset, silver processes several special qualities that justify the investment. Following is a list of a few of them.

AFFORDABLE

Silver Price Fintechzoom are expressed in terms of ounces on the financial markets. In a standard setting, one ounce of silver is equivalent to around 28.35 grams.

When compared to gold, investors believe silver to be a more cheap metal. Through Silver Price FintechZoom, even investors with modest capital may locate a viable chance to invest in and earn from.

Moreover, fractional ounces of silver are now offered, giving buyers of all stripes more purchasing options.

INVEST IN SILVER, SAFELY

Silver Price Fintechzoom is a long-lasting and valued precious metal. Sometimes silver retains its value while money does not. It is a physical asset that is a wise investment due to its industrial demand and seeming stability.

STRONG INDUSTRY DEMAND

Silver is highly demanded in industry, in contrast to gold. Silver is being used in new technologies because of its special qualities (such as conductivity, reflectivity, and antimicrobial characteristics) and adaptability. Below are some instances of how silver is used.

- Solar-powered

- Medical equipment

- Electronics

- Automotive sector

- Nanotechnology

- Purifying of water

- Electronics that are flexible and much more.

PAST TRENDS

Anybody who made an investment in silver years ago would be happy they did. Over the years, the silver market has experienced some amazing advances. Silver may provide profitable returns for astute investors in both bull and downturn markets.

However, novice investors may face some difficulties due to its volatility. However, by examining historical patterns and conducting a thorough statistical analysis of Silver Price Fintechzoom, you may choose wisely when making investments.

SILVER PRICE FINTECHZOOM-INFLUENCING FACTORS

Prices of Silver Price Fintechzoom fluctuate a lot. This is because they are influenced by a combination of factors. Some of the factors that influence the Silver market are as below.

INDUSTRY DEMAND

The expanding trend of technology is causing a new shift in demand for silver. A significant percentage of silver’s demand is now divided due to its industrial relevance. The demand from sectors like as healthcare, automotive, electronics, and other industries has the potential to drive up the price of silver.

DEMAND FOR INVESTMENTS

Institutions and governmental organizations, in addition to private investors, are also significantly influencing the fluctuations in the price of silver. Investors’ search for a safe haven, like silver, and their subsequent investment in it are being fueled by additional variables like inflation, geopolitical tensions, and economic instability. This leads to a rise in both the price and demand for silver.

CHANGES IN THE LEVELS OF PRODUCTION MINING

One of the main reasons for the market’s swings in Silver Price Fintechzoom is production mining. First, when production costs grow, miners may decide to halt operations or add purposeful delays, which might lead to a shortage of silver and an increase in its price.

Second, modern technical advancements can lead to an extraction and mining procedure that is more efficient, increasing the availability of silver and decreasing its price.

Thirdly, unanticipated events may disrupt the silver mining process and lower the amount of silver available for purchase, which might result in higher silver prices.

SILVER RECYCLING

The most accidental—yet significant—factor influencing the volatility of the silver market is silver recycling. Many disregard it as a secondary source of supplies. Thanks to technological advancements, miners can now extract and recycle silver from metal waste, boosting the metal’s supply and lowering its price.

CREATING THE MOST OF SILVER PRICE FINTECHZOOM -TOOLS AND FEATURES

ilver Price FintechZoom is a powerful collection of tools and features designed to empower investors in the silver market.

Some of the notable points are as below.

OVERVIEW OF SILVER PRICE FINTECHZOOM PLATFORM

The Silver Price FintechZoom platform provides its target market, which includes institutions, financial professionals, and individual investors, with an easy-to-use interface. Silver Price FintechZoom offers the greatest real-time market data, price movements, customisable charts, educational resources, tools, and techniques to enhance your financial journey—regardless of your level of experience.

TOOLS AND FEATURES

Below are a few of the main resources and functionalities offered by Silver Price Fintech Zoom.

- Live silver price updates

- Historical Data

- Customizable and Interactive Charts

- Financial News

- Educational Resources

- Portfolio Management

- Alerts and Notifications

- Community Forums

- Watchlists

- Mobile Application

To put it briefly, it is an effective set of instruments that may support investors in making wise choices about their purchases of silver metal.

REAL-TIME DATA ON SILVER PRICES

Overly meticulous investors constantly monitor the price of silver per minute. For this reason, real-time silver pricing data is made available by Silver Price Fintech Zoom, enabling investors to remain informed about the most recent trends and advancements in the silver market.

Investors may acquire precise and accurate insights into the patterns in the price of silver by utilizing live price charts (up to one minute), graphs, and statistics.

Below are a few examples of real-time market data snapshots that Silver Price Fintech Zoom has made available.

Features of AI and Machine Learning

FintechZoom stands apart from other investing platforms due to its use of AI and machine learning algorithms.

Using the most powerful algorithms available today, Silver Price FintechZoom is gaining recognition in the industry. The platform uses AI and machine learning capabilities to evaluate massive volumes of historical and real-time market data in order to spot trends, patterns, and possible business opportunities.

Deep insights into market dynamics, patterns of market rise and fall, predictive models providing predictions and projections of future trends, and customized investment strategies based on risk tolerance, preference, and investment quantities are all provided by the AI-driven study. In summary, investors may tailor their portfolios and generate significant returns by purchasing silver at the right price thanks to Silver Price FintechZoom’s AI capabilities at the right time.

METHODS FOR SILVER INVESTMENT

Determining your investment goals, risk tolerance, and preferred time horizon is crucial when making silver investments. By keeping these points in mind, you can reduce risk and make good money.

Some of the strategies are as below.

- Think of purchasing silver as tangible assets like coins, bullion, or bricks. It shields you against inflation and unstable economic conditions while assisting you in obtaining possession of a material item.

- Collectibles or silver jewelry are good investments. They may be employed in everyday chores and have some aesthetic appeal.

- Consider making investments in businesses engaged in the production and mining of silver. With the rising price of silver, you may benefit from this method. However, before making an investment in such a company, you should always conduct thorough investigation.

- Invest in exchange-traded funds that track silver (ETFs). These are the funds that are traded on stock exchanges and follow the price of silver.

- Additionally, you may put money into streaming services and silver royalties. These are the businesses who lend money to silver mining firms in return for a portion of their potential future profits.

- Another great way to invest your money is to use dollar-cost averaging. Using this method, you invest a certain amount of money in silver on a regular basis throughout time, independent of changes in price. By taking this method, you might possibly reduce the average cost of your assets over time and lessen the impact of short-term volatility.

INSIGHTS INTO THE SILVER MARKET

The price of silver is notoriously erratic, changing quickly in reaction to a variety of supply chain, geopolitical, and economic variables. Investors who want to prosper in this market must comprehend the many aspects behind silver’s price fluctuations. This involves using the Silver Price FintechZoom platform to follow demand globally, keep an eye on geopolitical tensions, analyze supply chain interruptions, and remain current with macroeconomic developments. Investors may modify their tactics to optimize profits and mitigate risks in the silver market by comprehending these crucial elements.

SILVER MARKET RISK MANAGEMENT STRATEGIES

Effective risk management techniques are necessary for silver market investments to be profitable. Following is a list of a few of them.

- Staying updated about the silver market prices

- Diversification i.e. spreading your investments across various assets.

- Implementing stop loss orders i.e. automatically selling silver positions if the price goes down below a specific price.

- Maintain liquidity for regular expenses in times of market volatility.

- Careful positioning sizing.

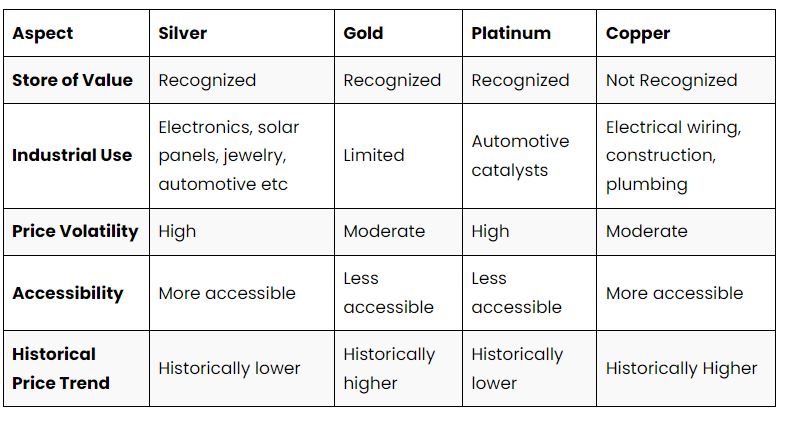

SILVER’S COMPARISON TO OTHER METALS

Here is a brief comparison of Silver with other popular metals today.

CONCLUSION

Ultimately, investing in silver has a number of benefits as well as some difficulties. A person may profitably trade silver provided they have a thorough understanding of the market dynamics, silver’s distinctive features, and how diverse and volatile the metal is.

To make it simple to monitor the silver market closely, Silver Price FintechZoom provides a range of functions and capabilities. These attributes may be used to help one make well-informed financial selections. Furthermore, by projecting silver prices for the future, machine learning and artificial intelligence characteristics can assist with portfolio planning.

Every metal has distinct qualities and financial possibilities, even though silver and other metals have certain similarities. You must investigate every kind of metal you intend to invest your funds in and FintechZoom is there to help you out so that you can make good returns!